Fiscal Sponsorship

Goodnation provides tax-exempt status along with a suite of digital tools and personalized support so you can confidently raise funds for your cause.

“Working with Goodnation has been the best decision we made as an organization and it has really enhanced our ability to make an impact. The level of credibility, streamlined operational support, and clarity Goodnation offers is invaluable!”

-Program sponsored by Goodnation

-

What is fiscal sponsorship?

As a tax-exempt organization, Goodnation can accept and disburse gifts on behalf of your program, in addition to a suite of comprehensive support, allowing you the time and confidence to fundraise and fulfill your mission without your own 501c3 or 501c4 status.

-

Who is fiscal sponsorship for?

If you are raising charitable funds for a cause you care about, and do not have your own tax-exempt status or plan to apply for it in the future, fiscal sponsorship may be a good fit for you.

-

What makes Goodnation different?

A real time and regularly updated view of your balance, frequent processing of payment to vendors, a responsive and flexible team, a portal for managing your program, the option of payroll and benefits and so much more are reasons why Goodnation’s fiscal sponsorship program is rapidly growing.

-

What types of sponsorship does Goodnation offer?

Goodnation offers Model A and Model C fiscal sponsorship. Goodnation Foundation can accept and manage 501c3 funds and Goodnation Action can accept and manage 501c4 funds.

“We have been with Goodnation since 2023 and we LOVE it! The team is flexible and accommodating and the relationship has allowed for us to grow and thrive.”

-Program sponsored by Goodnation

SFW Institute

Democratic Knowledge Project Launch

Proximity for Justice

Comprehensive Support

-

ACCEPT DONATIONS

We work with your funders, from individual donors to foundations, so they can make a tax-deductible gift using their preferred payment method.

-

COMPLIANCE

We handle compliance including annual audit, required IRS filings, issuing 1099s to vendors and sending tax deductibility acknowledgements to donors. Programs are covered under our general and professional liability insurance.

-

TRACKING

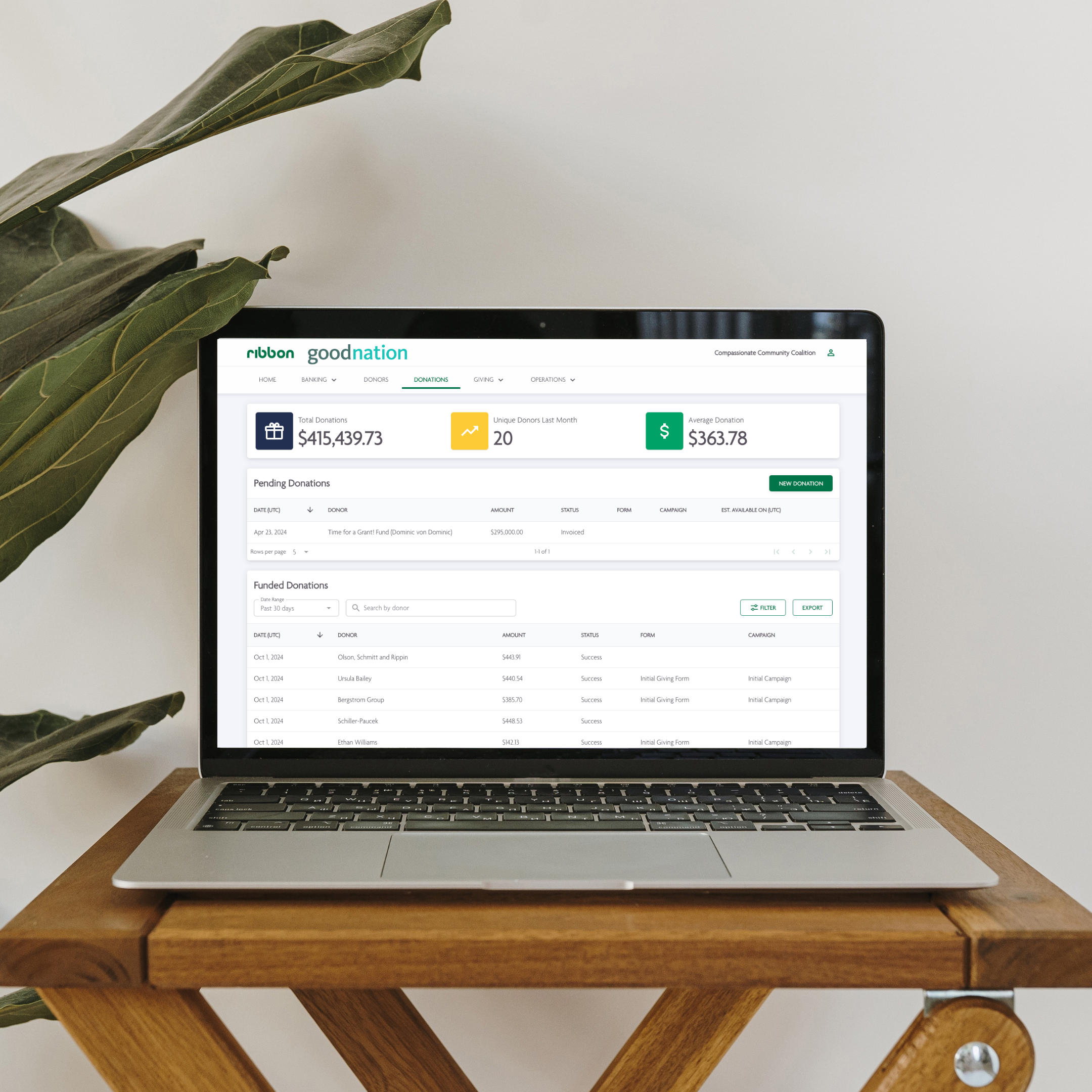

Through your account on our fiscal sponsorship platform, we provide a transparent view of incoming and outgoing funds, updated in real time, with reports available for download as well as the option to track specific budgets and grants with ease.

-

EXPENSES AND GRANTMAKING

We review and pay invoices and reimbursement requests weekly and help you get subgrants out the door quickly, as well as offer debit cards tied directly to your program’s balance.

-

PORTAL

Through your program’s portal on our fiscal sponsorship platform, view your real-time balance, track donations, process expenses, create debit cards, design a branded donation form, access compliance documents and various templates, and so much more.

-

HR SUPPORT

Hire independent consultants and W2 employees through Goodnation. We provide payroll, benefits, and compliance support for employees, such as health insurance, retirement plan, workers compensation insurance, and more.

-

PERSONAL SUPPORT

A kick-off call with the experienced Goodnation team to review logistics and operations, as well as ongoing support and quick response times from your dedicated Program Manager, means you are always in good hands.

-

ADDITIONAL BENEFITS

Goodnation is excited to participate in pilot programs for TechSoup and Candid, for the first time offering fiscally sponsored programs access to these platforms. In addition, take advantage of a Canva for Nonprofits account through us.

Through our Philanthropy Advising program, there may be the opportunity for us to introduce additional Goodnation donors to our fiscally sponsored programs.

“Goodnation cared and expressed a willingness to solve for our needs, where other fiscal sponsors had a generic box that we would need to fit into in order to work with them.”

-Program sponsored by Goodnation

Our Application Process

Apply: After reviewing our eligibility requirements and cost structure, below, submit your application, which allows us to get an understanding of your program. We accept applications on a rolling basis.

Exploratory call: Based on your application, if we feel you may be a good fit, we will schedule a call to learn more about each other. We are happy to schedule multiple calls and to answer additional questions over email.

Sign agreement: We will share an agreement for your review and signature.

Kick-off call: We will hold a kick-off call so you can meet your Program Manager, walk through our operations and logistics, and learn how to navigate your account on our fiscal sponsorship platform.

Eligibility

In order to qualify for fiscal sponsorship under Goodnation, you must be able to demonstrate the following:

Initiative in line with Goodnation’s mission

Prepared 24-month budget reflecting an annual fundraising goal of at least $200,000

Known network of existing or potential committed donors

Bandwidth and ability to develop and implement a strategic fundraising plan

Understanding that funds raised are to be used in line with c3 (or c4) work and not in pursuit of making a profit

Background checks on staff/volunteers if working with children

Not required, but a plus:

Dedicated advisory board

Understanding of lobbying (if applicable to your mission) and understanding of the use of c4 funds (if applicable to your funding strategy)

Get Started

To take the next steps, provide us with information about your initiative, your goals and what you are looking for from a fiscal sponsor.

Current programs sponsored by Goodnation

Foundations that have supported programs through Goodnation

Costs

Goodnation operates on a sliding scale dependent on your annual revenue. We do not charge a set-up fee.

Model A | Standard Sliding Scale:

7.5% up to $1M in annual revenue

6.5% up to $2.5M in annual revenue

5.5% up to $5M in annual revenue

4.5% up to $10M in annual revenue

3.5% up to $25M in annual revenue

2.5% after $25M in annual revenue

Model C | Standard Sliding Scale:

6.5% up to $1M in annual revenue

5.5% up to $2.5M in annual revenue

4.5% up to $5M in annual revenue

3.5% up to $10M in annual revenue

2.5% up to $25M in annual revenue

1.5% after $25M in annual revenue

Model A | Standard Plus Sliding Scale

For Model A programs seeking HR services, management of 501c4 funds, or with more complex needs, increased costs may apply. In addition, we pass on a monthly fee per employee to our programs for use of our payroll and benefits platform.

9.5% up to $1M in annual revenue

8.5% up to $2.5M in annual revenue

7.5% up to $5M in annual revenue

6.5% up to $10M in annual revenue

5.5% up to $25M in annual revenue

4.5% after $25M in annual revenue